How to add 4% to your profit

What is climate doing to you, and you to it? This is Sustainability Reporting.

This is Sustainability in the big picture of climate and humans on the planet.

Climate change raises a two-sided question. What impact does it have on the sustainability of your business (revenue, customers, supplies, risks)? And what impact does your business have on climate and thus the broader sustainability of our society and environment.

This distills down to one sustainability question.

Customers, regulators, and investors are asking, “What is your commitment?” They are referring to two major scenarios for the future.

To simplify them in business terms:

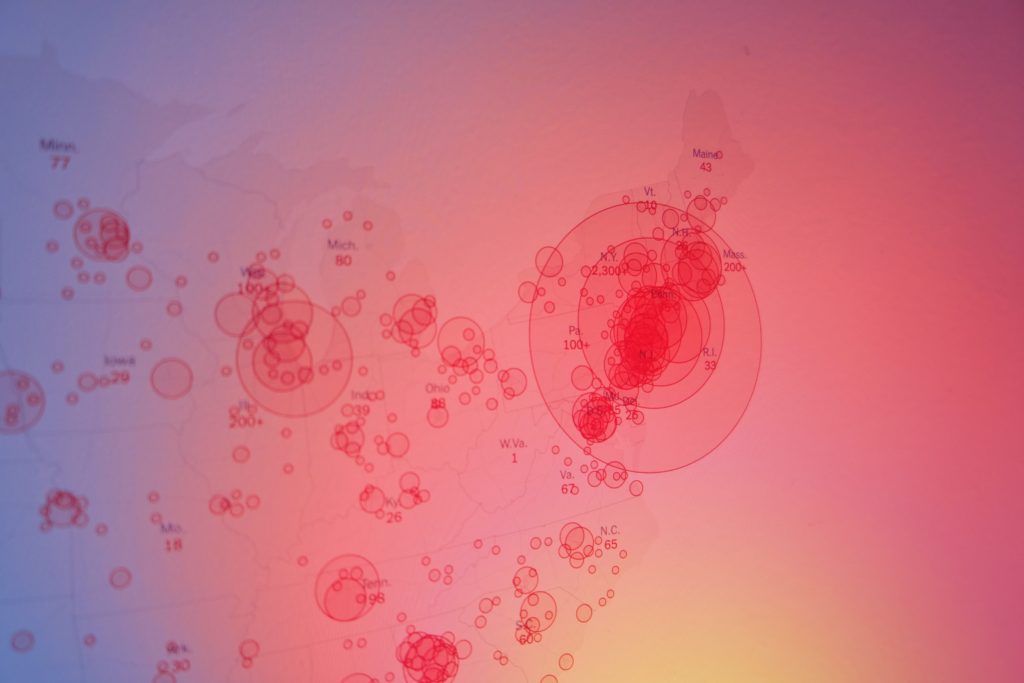

The Red Scenario. Are your business and your investment practices aligned to a future that will see global temperatures rise by 3˚C or more? This is the dire world of the planet burning and social collapse. Standard & Poor’s, a ratings agency, reports that 66% of companies are unknowingly operating this way, even those that have publicly committed to “going green.”

The Green Scenario. Are your business and your investment practices aligned to a future that is +1.5˚C or less? This is the desired world climate that has so far allowed human beings to flourish. This is the sustainable scenario that CEOs are increasingly being tasked to deliver.

Let’s drill into these two scenarios further.

The Red Scenario has two sub-types: Dire and Diabolical.

Dire is when our enterprise and business systems adjust to simply delivering a 3˚C+ world. This world has hundreds of millions displaced, stretched food systems and 100 year floods, fires and droughts happening every 20 years or so.

Dire is not good.

Diabolical is Dire on steroids. 100 year disasters-a-decade. This is the trajectory of current business practice which lead to a potential 5˚C+ world. Neither red sub-type is desirable.

Think about it like this. The lifestyle our businesses currently lead means we’ve got a bit (or more than a bit) overweight and out of shape. The doctors have pointed out that diabetes and cardiac arrest are imminent.

Step 1 is to stop adding the gunk into our system.

Step 2 is to clean up what we’ve already done to ourselves.

To achieve the Green Scenario, we must play a different game.

The clever thinkers

The green goal is to stop adding carbon to the atmosphere and then to remove it to promote a return to a climate that’s healthy for humans and other species—and, at the same time, to create highly valuable businesses and a thriving society. #Healthy&Wealthy

The Green Scenario for a business has three sub-types:

- Going net-zero: This is where a business adds carbon and offsets what they add. It’s the binge and exercise option.

- Going carbon-neutral: This is where a business shifts how it does business so that it’s using processes and products that do not create carbon. This is the option to maintain your weight and reduce health risks.

- Going regenerative: This is where a business decides to get healthier and fitter than ever before. It’s getting carbon-neutral and dropping those Kgs. It’s a distinct lifestyle change.

The clever thinkers are already looking at three additional elements.

- Are your planning and processes creating a ‘just transition?’ This asks you to look at the social impact of your strategy and how you can make it socially fair on the poorer elements of society.

- Are you aligned to ‘science-based targets’? Science-based targets look across the economic system that businesses align to so that we don’t inadvertently do damage somewhere else while we take action on any one dimension.

- Are you simply addressing your own internal operations or are you looking at what it really takes to create value? This is referred to as ‘Scopes 1, 2, and 3’ – and are a subject for another primer.

Investors, regulators, and customers are asking for insight on sustainability and your climate risks. They look at how well you’ve refreshed your strategy to incorporate your climate goals. They’ll ask about your climate ambition—what scope you are committing to and what you are doing to achieve it.

It’s the business version of keeping up good relationships, not over-training and making sure your business ecology is sustainable.

For Businesses in Asia

Committing to the Green Scenario has direct economic value now. The EU is introducing a 4% levy on goods that are not produced in alignment with the EU taxonomy on Sustainability. They are doing this to create a level playing field so that imported goods pay an equivalent price to the cost of carbon in the EU. This carbon border levy is called the Carbon Border Adjustment Mechanism (CBAM).

On the basis that what gets measured gets done, there are a variety of initiatives to assist you in adapting to the Green Scenario.

There are policy initiatives. The EU’s New Green Deal is the driver behind CBAM. The Sustainable Development Goals (SDGs) are a set of 17 goals with 156 sub-elements that, while primarily designed for countries, can also provide insights for companies assessing where they have positive or negative impact. The Global Reporting Initiative (GRI) helps you understand and report impact across a range of issues such as climate change, human rights, and corruption.

There are also Investor initiatives. The Principles for Responsible Investment (PRI) is the future facing version of investment where money is expected to do more than simply make money—it’s expected to create an impact too. Issue-focused initiatives are increasingly active; for example, Climate Action 100+ ensures that the world’s largest 100 corporate greenhouse gas emitters take necessary action on climate change.

Science says we have a decade to get green. And then another decade to get greener so that we have headed off the worst of the red scenario. This is where the ‘by 2030’, ‘by 2040’, and ‘by 2050’ markers come into the discussion.

Ambition

In summary, your climate ambition is your commitment to:

(a) net-zero, carbon neutral or regenerative

(b) your scope of ambition 1, 2 or 3 and

(c) your timeline for each element e.g. 2025, 2030, 2040 etc.

Your climate strategy is your plan to respond to external changes while delivering on this commitment along with your financial and other commitments.

In the absence of a stated climate ambition or strategy, continuing ‘as is’ also known as ‘business as usual’ (BAU), implying an enterprise is defaulting to a red scenario pathway (S&P July 7 2021).

If your enterprise does not know it’s impact on sustainability, there may be unknown, unquantified liabilities in the not-too-distant future – rendering your business unsustainable to stakeholders and the planet.

In the next article in this series, we will focus on what [un]Sustainability does to create and erode enterprise value.

I’m Joanne Flinn. I help CXOs win deep leading transitions for a 1.5 degree world. My next book, Greensight the New Liability for Directors and Named Individuals is coming out soon.

#Greensight #Sustainability #BoardDirector

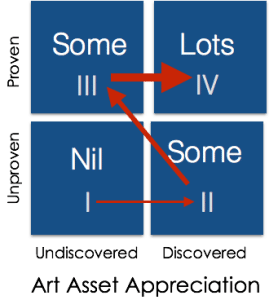

What’s Proven: an artist that exhibitions in multiple countries, and has been exhibited in top galleries or museums

What’s Proven: an artist that exhibitions in multiple countries, and has been exhibited in top galleries or museums